nd sales tax rate 2021

Sales taxes are a significant part of the tax base for a state. South Dakota and Utah did so only in comparison to those that enacted more substantial local rate increases.

North Dakota Tax Rates Rankings Nd State Taxes Tax Foundation

The North Dakota sales tax rate is currently.

. 2021 state and local sales tax rates. The maximum local tax rate allowed by North Dakota law is 3. You can refer to the outlined rates below.

A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount. At the present time the City of Minot has a 2 city sales use and gross receipts tax. Sales tax or use tax is any tax thats imposed by the government for the purchase of goods or services in the state of North Dakota.

Start filing your tax return now. 5 State Taxes 196 Average local tax 696 Combined Tax Property Taxes. Look up 2021 sales tax rates for Grand Rapids North Dakota and surrounding areas.

Tax rates are provided by Avalara and updated monthly. Wayfair Inc affect North Dakota. Their North Dakota taxable income is 49935.

30 rows The state sales tax rate in North Dakota is 5000. 2022 North Dakota Sales Tax Changes Over the past year there have been sixteen local sales tax rate changes in North Dakota. The tax rate for Minot starting October 1.

1 is set to expire on September 30 2021. Local lodging local lodging and restaurant alcohol tobacco excise taxes etc. You can lookup North Dakota city and county sales.

Has impacted many state nexus laws and sales tax collection requirements. WHAT IS THE SALES TAX RATE IN NORTH DAKOTA. Any sales tax that is collected belongs to the state and does not belong to the business that was transacted with.

The 2018 United States Supreme Court decision in South Dakota v. 100 rows NORTH DAKOTA STATE COUNTY CITY SALES TAX RATES 2021 Register Online This page lists an outline of the sales tax rates in North Dakota. Updates are posted 60 days prior to the changes becoming effective.

The County sales tax rate is. City of Fargo North Dakota Pursuant to Ordinance 5303 as adopted June 28 2021 the boundaries of the City of Fargo will change for sales and use tax purposes effective January 1 2022. ND Rates Sales Tax Calculator Sales Tax Table.

374 rows 5 Average Sales Tax With Local. Some rates might be different in North Dakota State. How much is sales tax in North Dakota.

Groceries are exempt from the North Dakota sales tax Counties and cities can charge an additional local sales tax of up to 3 for a maximum possible combined sales tax of 8. Ad Try Returns For Small Business Avalaras low cost solution built for omnichannel sellers. Explore 2021 sales tax by state.

Please refer to the following links if you are a business owner and need to learn more about obtaining a sales tax permit or making tax-exempt purchases for resale. Find your North Dakota combined state and local tax rate. 596 North Dakota has state sales tax of 5 and allows local governments to collect a local option sales tax of up to 3.

The Bismarck sales tax rate is. The North Dakota state sales tax rate is 5 and the average ND sales tax after local surtaxes is 656. They are second only to income taxes and give a straight forward way to collect tax revenue.

2022 North Dakota Sales Tax Table. Find 49900 - 49950 in the. With local taxes the total sales tax rate is between 5000 and 8500.

Skip to main content Sales877-780-4848 Support Sign in Solutions Products Resources Partners About Blog Search. Tax rates are provided by Avalara and updated monthly. The state sales tax rate in North Dakota is 5 but.

North Dakota has recent rate changes Thu Jul 01 2021. This page will be updated monthly as new sales tax rates are released. The base state sales tax rate in North Dakota is 5.

Schedule ND-1NR line 22 to calculate their tax. Local tax rates in North Dakota range from 0 to 35 making the sales tax range in North Dakota 5 to 85. If your ND taxable.

Sales Tax Rates 2021. Select the North Dakota city from the list. This table lists each changed tax jurisdiction the amount of the change and the towns and cities in which the modified tax rates apply.

Pursuant to Document 144641 as adopted May 5 2021 the boundaries of the City of Elgin will change for sales and use tax purposes effective April 1 2022. Arkansas went from 2 nd to 3 rd highest on its own meritalthough the actual change in its local. Municipal governments in North Dakota are also allowed to collect a local-option sales tax that ranges from 0 to 45 across the state with an average local tax of 096 for a total of 596 when combined with the state sales tax.

Compare 2021 sales tax rates by state with new resource. Look up 2021 North Dakota sales tax rates in an easy to navigate table listed by county and city. TAX DAY NOW MAY 17th - There are -428 days left until taxes are due.

North Dakotas sales tax rates for commonly exempted categories are listed below. Click here for a larger sales tax map or here for a sales tax table. Taxpayers are residents of North Dakota and are married filing jointly.

It does not include special taxes such as. Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase. The base state sales tax rate in North Dakota is 5.

Did South Dakota v. There are a total of 213 local tax jurisdictions across the state collecting an average local tax of 096. Local Sales Tax Rate Lookup The Sales and Use Tax Rate Locator only includes state and local sales and use tax rates and boundaries for North Dakota.

States and the localities within them can use standardized rates to give a weighted average of expected collection amounts.

North Dakota Estate Tax Everything You Need To Know Smartasset

How Do State And Local Individual Income Taxes Work Tax Policy Center

States Can Thoughtfully Implement Grocery Tax Reforms To Help Families And Improve Equity Center On Budget And Policy Priorities

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

North Dakota Tax Rates Rankings Nd State Taxes Tax Foundation

State Income Tax Rates Highest Lowest 2021 Changes

States With Highest And Lowest Sales Tax Rates

North Dakota Tax Rates Rankings Nd State Taxes Tax Foundation

Sales Tax On Grocery Items Taxjar

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

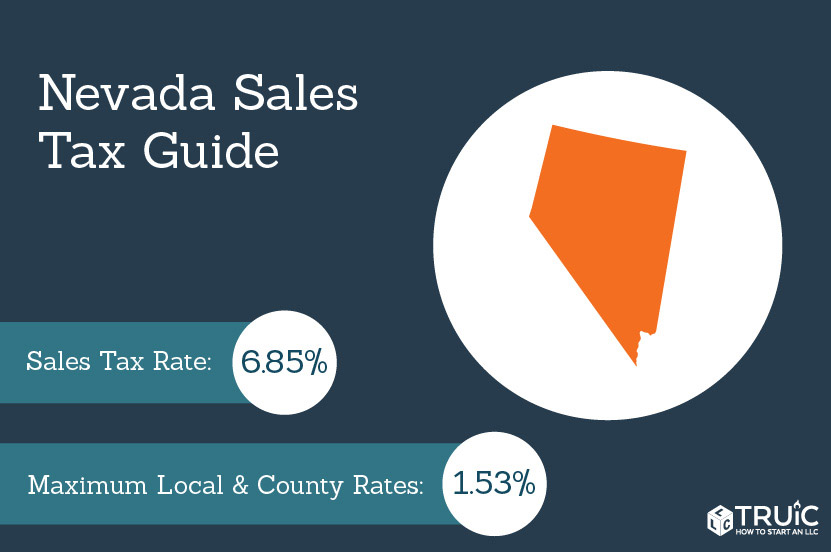

Nevada Sales Tax Small Business Guide Truic

North Dakota Tax Rates Rankings Nd State Taxes Tax Foundation

Seattle King County Realtors Higher End Homes Hit By Excise Tax Rate Increase

North Dakota Tax Rates Rankings Nd State Taxes Tax Foundation