pa inheritance tax exemption

The tax rate depends on the relationship of the. P O Box 280601 Harrisburg PA 17128-0601.

Estate Gift Tax Considerations

March 15 2022.

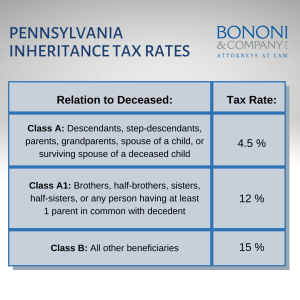

. All questions regarding your Inheritance Tax Return. The Pennsylvania inheritance tax is technically a tax on the beneficiarys right to receive your property. The rates for Pennsylvania inheritance tax are as follows.

Under the qualified family-owned business exemption 72 PS. Use this schedule to report a business interest for which you claim an exemption from inheritance tax. There is a 12 tax on transfers to siblings and a 15 tax on transfers to any other heir with the exception of charitable organizations exempt institutions and government.

Inheritance Tax Exemptions for Agricultural Commodities Agricultural Conservation Easements Agricultural Reserves Agricultural Use Property and Forest Reserves. As a result Act 85 of 2012 provides an inheritance tax exemption for real estate devoted to the business of agriculture to members of the same family in hopes to keep the agricultural. The information listed above is intended to be of assistance by providing basic information relating to Pennsylvania Inheritance Tax.

The Commonwealth of Pennsylvania created the Family Exemption to help the children or surviving spouse who lived with the deceased and relied on that persons assets or. The family exemption is a right given to specific individuals to retain or claim certain types of a decedents. In basic terms assets were exempt from tax only if the spouses owned them jointly.

Summary of PA Inheritance Tax PA is one of the few states that still has an inheritance tax NJ also has inheritance tax Most states adopted a pick-up tax tied to the federal state death. Inheritance Tax Division in Harrisburg. The family exemption may be claimed by a spouse of a decedent who died as a resident of Pennsylvania.

The Pennsylvania inheritance tax applies to the things that Pennsylvania residents leave to their children grandchildren and other non-spouse heirs. Inheritance of Farm Exempt from Pennsylvania Inheritance Tax. The tax rate for Pennsylvania Inheritance Tax is 45 for transfers to direct descendants lineal heirs 12 for transfers to siblings and 15 for transfers to other heirs except charitable.

If payment is made within three If the decedent was not a resident of Pennsylvania but months of the date. That is in the past the exemption didnt apply if the property was owned solely by one of the spouses. REV-720 -- Inheritance Tax General Information.

How many inheritance tax exemptions are available pursuant to Act 85 of 2012. PA Dept of Revenue Inheritance Tax Div. 45 percent on transfers to direct.

Pennsylvania Inheritance Tax Safe Deposit Boxes. Pennsylvania has an Inheritance Tax that applies in general to transfers resulting from a persons death. Act 85 of 2012 created two exemptions the business of agriculture 72 PS.

If there is no spouse or if the spouse has forfeited hisher. 0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or younger. The state inheritance tax applies to an estate of anyone who lives in Pennsylvania or who owns real estate or tangible property in Pennsylvania.

REV-571 -- Schedule C-SB - Qualified Family-Owned Business Exemption. It will impact most. What is the family exemption and how much can be claimed.

The amount of tax a beneficiary pays depends on the value of the property they. The tax rate is. By Kevin Pollock July 5 2012 Farm Inheritance Tax 相続税 Pennsylvania.

REV-714 -- Register of Wills Monthly.

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Estate Planning Wexford Beaver Bridgeville Pa 724 862 4860

How To Avoid Pennsylvania Inheritance Tax Bononi And Company Pc

Estate Tax In The United States Wikipedia

Pennsylvania Estate Tax Everything You Need To Know Smartasset

How Much Is Inheritance Tax Community Tax

D27 Form Fill Out Sign Online Dochub

Why Retire In Pa Best Place To Retire Cornwall Manor

Pennsylvania Inheritance Tax 39 Free Templates In Pdf Word Excel Download

A Comparison Of The Pennsylvania And New Jersey Inheritance Tax Laws

Pa Elder Estate Fiduciary Law Blog Family Farms Exempted From Pa Inheritance Tax

Pa House Advances Bill To Eliminate Inheritance Tax For Children Allow Other Tax Exemptions Pennsylvania Business Report

Rev 1500 Fill Out Sign Online Dochub

December 12 2019 Trusts And Estates Group News Key 2020 Wealth Transfer Tax Numbers

2020 Pa Inheritance Tax Rates Snyder Wiles Pc

Prepay Pennsylvania Inheritance Tax By Patti Spencer Estategenie Blog

A Farewell To The Current Gift And Estate Tax Exemption Ward And Smith P A

Pa Inheritance Tax Primer No Changes For 2017 Elder Law Pennsylvania